Price Volume Mix analysis in TM1

I was just reading through Price Volume Mix analysis IBM Accelerator template and it would have been be so useful for me about 5 years back when I had to create our own template for a pharmaceutical model. Here’s some of my ramblings about it.

What is PVM

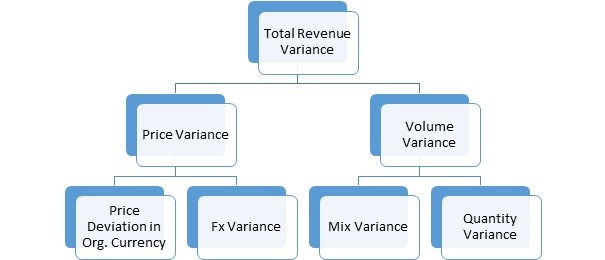

Price volume variance is a standard analysis for so called ‘widget’ companies (selling products as opposed to services), you’d see it often in FMCG, pharma, consumer product companies. It’s goal is to break down the sales variance between different scenarios and attribute the difference to:

- volume : are we selling more or less

- price : are we charging more or less

- currency impact: we’re doing all the same, but FX changed

See this great post for more details.

Visually you’d want to build a ‘bridge’ between 2 scenarios attributing the variance, like this:

that shows that the difference between FY15 and FY16 of 15k is split 10 / 5 between volume and price, so we’re getting 10k more cause we’re selling more and 5k more cause we’re charging more.

Or like this if you’re into multiple axises charts:

that shows that the difference between FY15 and FY16 of 15k is split 10 / 5 between volume and price, so we’re getting 10k more cause we’re selling more and 5k more cause we’re charging more.

Or like this if you’re into multiple axises charts:

What to take into consideration when implementing

IBM template includes so many important things from the get go:

- Selecting the level of product (or any any dimension for that matter) to calculate on, i.e. you can have an impact on a particular SKU, but not the product line itself

- Having COGS as well as Gross Sales & Net Sales is very beneficial for end to end analysis. Be careful with Gross Margin effects though, they quickly become very tricky to calculate correctly.

- Currency impacts and restatements – you need to think this one through and through, I’m not 100% sold on 2 currency dims in the template (I used 1), but comparable rates are a must.

There’s a few other ‘talking points’ I’d add:

- Always think about adding more accounts to ‘drill down’ in the analysis, i.e. have price moved because we’re giving more rebates or volume discounts? I try to add the whole Gross Sales to Margin revenue account structure ‘just in case’

- adding a repackaging / ‘creating a comparable’ product functionality that allows you to ‘restate’ the various scenarios to a similar product mix. Replacing a product with a new version of the same product (or a different packaging in pharma) would look like a massive volume impact on the old product, but it’s not necessary the case. Pharma’s approach at some point is to go to things like ‘per mg of active ingredient / doses / vials’ comparisons

- I would avoid doing it in the same part of the model as the other calculations on any decent sized model, a separate reporting cube populated by TIs is the way to go. This analysis requires a lot of C level rules that are caching & performance killers.

- unsurprisingly we couldn’t standardise this calculation even for different country branches of the same company and it’s still a hard thing starting from a template model, C-level rules will do your head in